April 6, 2017

Changes in US infrastructure positive for seaborne exports

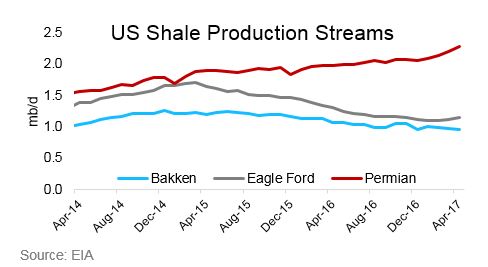

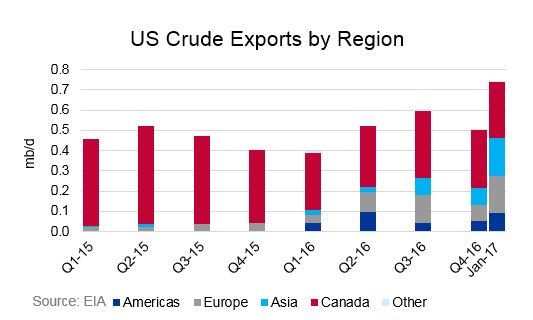

Last month, we discussed changes to US crude production and the resulting uptick in seaborne US crude exports as it relates to global oil pricing. While global benchmark pricing is having a direct impact on the desirability of US light sweet crude moving to global markets, there are some finer details making it easier and more economical for US producers to get their barrels to international markets. Despite reduced production in the Bakken and Eagle Ford shale fields as a result of ongoing low oil prices, a decrease in the cost of production in the Permian Basin has elevated production by ~0.4 mb/d from Jan’16 to Apr’17. Coupled with the rapid expansion of pipeline capacity into the US Gulf, including the 470 kb/d Dakota Access Pipeline expected online in Q2-2017, as well as an additional 340 kb/d of pipeline expansions by the end of 2017, the expectation is that US crude exports out of the US Gulf will continue to increase. Finally, the build out of a new export-capable Aframax terminal in the US Gulf will make it easier to ship barrels out, which will be positive for mid-sized tankers. |

|