June 9, 2016

OPEC production to remain high, supporting crude tanker demand

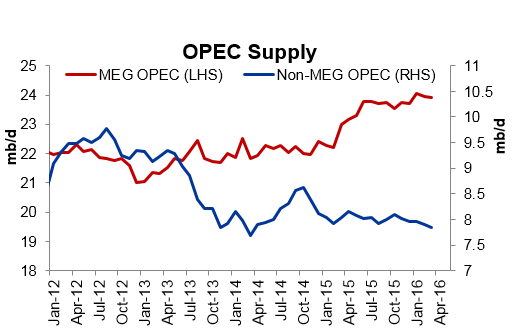

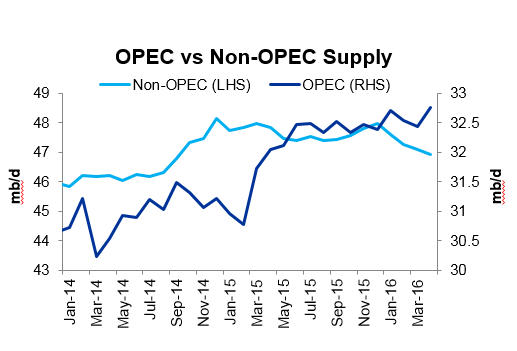

OPEC members met in Vienna on June 2 to discuss production strategies, and what, if anything, they can do to reverse the slump in oil prices. While OPEC was unable to come to an agreement on a production freeze or production quota for member nations, they did agree that market pressures were having the desired effect of pushing out non-OPEC supply such that oil supply and oil demand will rebalance. The decision to let the market decide has resulted in a As the chart below illustrates, Middle East OPEC producers have steadily increased production since the start of January, 2015. This increase has largely been driven by Iraq and Saudi Arabia, with recent additions from Iran as sanctions were lifted at the beginning of 2016. However, non-Middle East OPEC producers, including Libya, Nigeria, and Venezuela, have struggled with geopolitical instabilities such that their production as of April 2016 has declined by ~0.3 mb/d from the beginning of 2016. This figure will be closer to 0.9 mb/d for May as recent militant attacks in Nigeria have brought ~0.6 mb/d offline.

OPEC Supply |

OPEC vs Non-OPEC Supply |