May 9, 2016

Liberation of teapot refiners positive for crude tanker demand

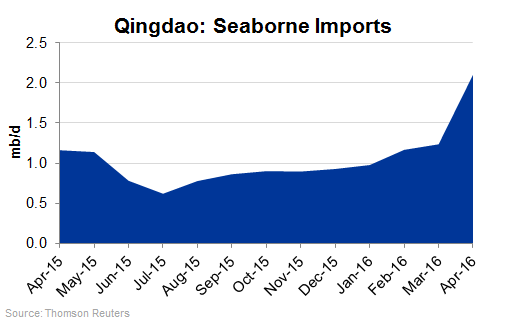

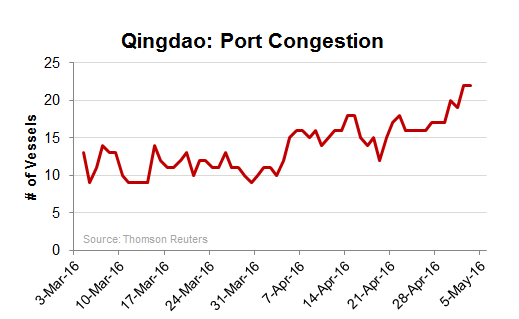

China recently granted licenses to eleven independent Chinese refineries, known as teapots, permitting them to import crude from global markets. Prior to the licenses being granted, only the major state-owned oil companies were permitted to import crude oil, and teapot refineries had to either reprocess fuel oil or source their crudes from the state. With the newly granted licenses, these select refiners have turned to some of the world’s largest crude exporters as they seek to improve their margins. Such moves into the global marketplace are very positive for crude tanker demand. The lion’s share of these teapot refineries are in Shangdong province, and Qingdao is the key import terminal in the region. The increase in seaborne imports into Qingdao has been profound as cargos from all over the globe have been arriving at the port, causing long lines of tankers waiting to discharge. Volumes of crude oil arriving at Qingdao have risen by ~80% year-on-year, to 2.1 mb/d by the end of April, compared to 1.1 mb/d in April 2015.

Qingdao: Seaborne Imports |

Qingdao: Port Congestion |