April 6, 2018

Demolition Derby

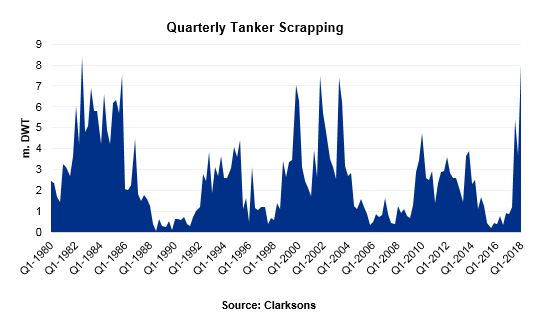

Think back to 1982. “E.T. the Extra-Terrestrial” was top at the box office and Michael Jackson’s “Thriller” was number one in the charts. Sony released the first commercial CD player, and a gallon of gasoline cost just 92 cents. It was also the last time we saw 8 mdwt of tankers scrapped in a single quarter… until now.

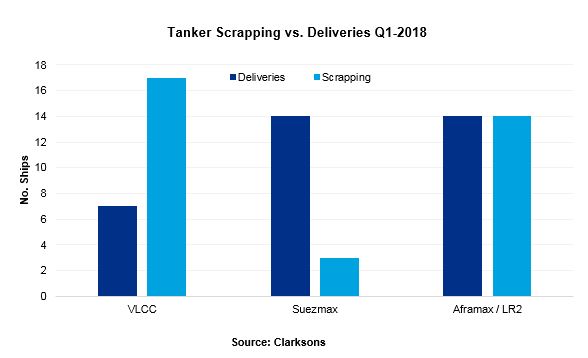

Tanker scrapping has started 2018 with a bang, as a combination of low freight rates, high scrap prices, an aging tanker fleet, and the impact of upcoming vessel regulations have combined to create the perfect “scrap storm”. Since the start of the year a total of 8 mdwt of tankers have been scrapped, including 17 VLCCs, 3 Suezmaxes and 14 Aframaxes. The average age of scrapping has been 20 years, though the total includes a significant number of vessels in the 17-18 year category. This indicates that many Owners are deciding not to go through with the 17.5 year intermediate survey, particularly in the VLCC sector where earnings have been sub-OPEX for much of 2018.

|

|

If this pace of scrapping is maintained for the rest of the year, tanker fleet growth could be close to zero in 2018 (or even negative for the first time since 2001). Our view is that low earnings and high scrap prices will continue to spur scrapping throughout the year; however, it is perhaps too much to hope that the torrid pace seen in Q1 will be maintained. Scrap prices have started to ease back from the peak of $480 per ldt seen in March, and tanker earnings have firmed slightly in recent weeks (albeit to levels which barely cover OPEX).

The recent increase in scrapping was anticipated, however the volume of vessels scrapped has exceeded all expectations. This elevated scrapping should be a positive for the tanker market as we move through 2018, particularly during the second half of the year when we expect an improvement on the demand side due to a rebalancing of oil markets and an easing of OPEC supply cuts.