March 8, 2018

Recent uptick in orders and capacity reductions have better positioned the yards

In 2016, the shipping industry experienced a dramatic collapse in newbuild orders due to a weak market environment across all shipping segments. As a result, 2016 saw the lowest number of orders since the early 1990s. As we quoted when we first wrote about the collapse, “it is not the strongest of species that survives, nor the most intelligent, but the one most adaptable to change”.

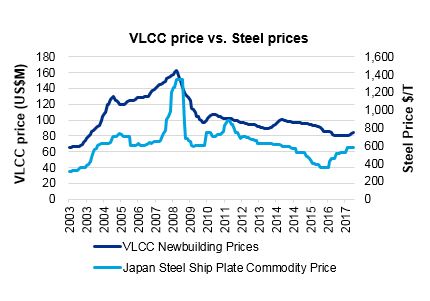

Going into 2017, Korean banks started to exert their influence over decision making by not letting Korean yards take loss-making contracts. The Chinese government consolidated shipbuilding capacity, and let many smaller second and third tier yards fail. Meanwhile, steel prices rebounded from $360/T to $460/T by the end of 2017, which impacted profit margins. As a result, shipyards were limited in their ability to discount in order to attract orders. Instead, the shipyards adapted by cutting costs through capacity closures and headcount reduction. We estimate that total global shipyard capacity was reduced by 30% during this time.

|

|

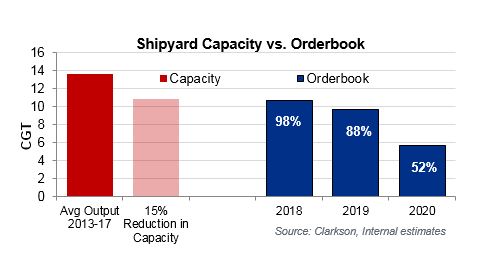

Through the course of 2017 (and early 2018) we have seen an increase in newbuilding ordering as shipping markets recover. In particular, we have seen an increase in VLCC, containership and large bulk carrier ordering, as well as a slight uptick on LNG carrier / FSRU ordering, most of which has been ordered at top-tier shipyards. This increase in ordering, coupled with a reduction in shipyard capacity, has put yards in a much better position than they were 2-3 years ago. The chart above shows the current orderbook at top-tier shipyards vs. the theoretical capacity (assuming a 15% reduction in total capacity at top tier yards vs. 2013-17 average output) and shows that the yards are largely full through 2019, and are approximately 50% full through 2020.

Shipbuilding capacity reductions and increased ordering has led shipyards to increase their newbuild price ideas. According to Clarksons, the lowest VLCC order price in 2017 was US$80M, but today’s estimated price is US$84.5M. We anticipate this price trend to continue through 2018 as additional orders from other shipping segments will continue to fill shipyard capacity.