January 12, 2016

The End of the US Crude Export Ban Could Be Positive for Tanker Demand

On December 18th, 2015 the US lifted the 40-year ban on exporting domestically produced crude oil. The ban, put in place during the Arab oil embargo in 1975, was intended to preserve national energy security and alleviate some of the reliance that the US had on Middle Eastern oil producers. However, the dramatic growth in US shale oil production since 2008 has drastically altered the US energy landscape and made the need for a crude oil export ban redundant. US shale oil is very light and sweet, similar to global benchmark crude Brent, and produces a high yield of gasoline, jet fuel, and naphtha compared to heavier and more sour grades. Such yields are attractive to global buyers, and as such we anticipate that those looking to diversify their supply sources, or purchase from a more geopolitically stable region, may consider US crude should it make economic sense. In addition, as the price of WTI rises to meet global benchmarked crudes, US refiners will have more options to source their crudes rather than being bound by land-locked, and thus cheaper, US barrels. Since May 2014, Canada has absorbed 93% of all US crude oil exports. In the long term, we could see many of these barrels diverted away from Canada towards global markets now that exports are permitted. We expect that many US exports will end up in Europe, displacing WAF barrels that will likely need to find a home in Asia. Not only will that increase tanker demand for US export requirements, but will also increase tanker demand for Canadian import requirements as Canada will seek to replace lost barrels. However, this is largely a long-term view given that current price conditions do not support large scale US exports. Trade of US crude will require a Brent-WTI arbitrage for it to have a meaningful impact on tanker markets.

The import demand for Brent-linked barrels could increase, however, given that US refiners, particularly on the East Coast, will switch their supply from domestic to WAF (or similar crudes) when the economics make sense. Demand for Aframaxes and Panamaxes could see some upside as a result.

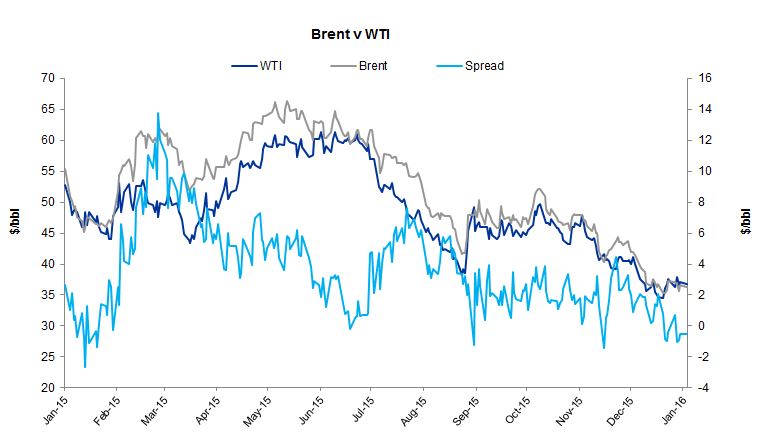

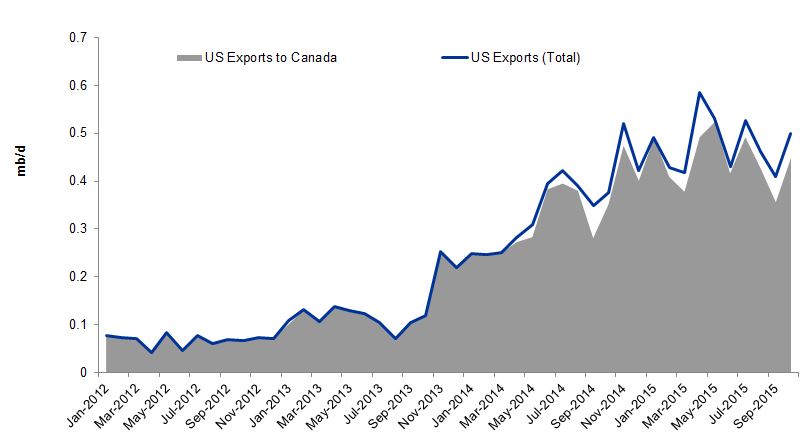

Since May 2014, Canada has absorbed 93% of all US crude oil exports. In the long term, we could see many of these barrels diverted away from Canada towards global markets now that exports are permitted. We expect that many US exports will end up in Europe, displacing WAF barrels that will likely need to find a home in Asia. Not only will that increase tanker demand for US export requirements, but will also increase tanker demand for Canadian import requirements as Canada will seek to replace lost barrels. However, this is largely a long-term view given that current price conditions do not support large scale US exports. Trade of US crude will require a Brent-WTI arbitrage for it to have a meaningful impact on tanker markets.

The import demand for Brent-linked barrels could increase, however, given that US refiners, particularly on the East Coast, will switch their supply from domestic to WAF (or similar crudes) when the economics make sense. Demand for Aframaxes and Panamaxes could see some upside as a result.

For more market insights, visit our market insights page.

For more market insights, visit our market insights page.